The approval of Bitcoin Exchange-Traded Funds (ETFs) has led to a remarkable year in cryptocurrency, with Bitcoin ETFs breaking records and reaching new heights since the beginning of 2024. BlackRock’s iShares Bitcoin Trust (IBIT) is a significant factor driving this growth, which reached a net asset value (NAV) of $33 billion last week. This growth coincided with Bitcoin’s latest record-breaking price of over $80,000, solidifying IBIT’s dominance in the ETF market. This milestone has positioned IBIT slightly ahead of BlackRock’s gold ETF, which has maintained substantial assets over its two-decade lifespan.

Bitcoin ETFs have achieved in less than a year what it took traditional ETFs years to build, marking a transformative shift in investment markets. ETFStore President Nate Geraci emphasized the speed of this shift, calling it “absolutely wild” that Bitcoin could achieve such dominance within just 10 months. IBIT’s growth reflects the public’s appetite for digital assets and a broader trend toward diversifying investments with alternatives to traditional assets like gold.

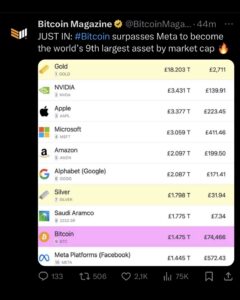

Despite Bitcoin’s explosive growth, 2024 has also been a landmark year for gold. Starting the year at around $2,000 per ounce, gold rose to an all-time high of $2,800 in October, marking a 40% increase. Bitcoin, however, has climbed even more dramatically, doubling its price from approximately $43,000 to the latest $80,000 in less than a year. This surge has propelled Bitcoin’s market value ahead of major corporations like Meta Platforms, securing its place as the ninth-largest global asset and putting it within range of silver’s market cap, which stands at approximately $1.77 trillion.

While gold remains the most valuable global asset at over $18 trillion, experts see immense growth potential for Bitcoin. VanEck CEO Jan Van Eck projected that Bitcoin could eventually reach half of gold’s market cap, translating to a value of around $300,000 per Bitcoin. He called this target “reasonable,” noting the rising institutional interest and speculating on the possibility of crypto becoming a bipartisan issue in the US following Trump’s presidential win. This growing support for Bitcoin, both in the public and institutional domains, is fueling speculation about its potential to rival gold as a store of value and inflation hedge.

As Bitcoin ETFs continue to flourish, their success not only boosts Bitcoin’s market status but also reshapes investment opportunities, hinting at an era where digital assets play an increasingly central role in traditional finance.