Managing finances effectively can be a challenge, whether you’re an individual trying to grow your wealth or a business striving to optimise resources. A well-structured finance portfolio can make all the difference, offering tailored strategies to maximise returns and minimise risks. This article explores how portfolio services cater to both individuals and businesses, ensuring financial stability and growth.

Why Financial Portfolios Matters

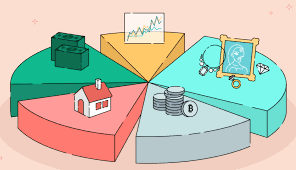

A finance portfolio is a collection of assets, including investments, savings, and other financial instruments. Its primary purpose is to manage wealth effectively by balancing growth potential with risk management. For individuals, this might involve preparing for retirement or achieving personal goals, while businesses often focus on liquidity, expansion, and sustainability.

In today’s financial environment where we live and operate, crypto portfolios are especially important topic, as they make up an increasingly significant share of the financial portfolios of individuals and businesses.

The complexity of financial markets and the risks of mismanagement make professional portfolio services invaluable. Experts can help clients diversify assets, reduce exposure to market volatility (especially on the crypto markets), and create strategies aligned with their financial goals, helping them to make personalised informed decisions.

Portfolio Services for Individuals

For individuals, portfolio services focus on personal goals and financial health:

- Personalised Investment Planning: These services start with understanding your objectives, risk tolerance, and timeline. Investments are then tailored to match your specific needs, ensuring a balanced and efficient approach.

- Retirement Planning: Building a secure retirement fund is crucial for long-term financial independence. Professional services ensure a mix of assets that grow steadily over time.

- Wealth Protection: A finance portfolio isn’t just about growth; it’s about safeguarding what you’ve earned. This often includes insurance and contingency funds to address unexpected challenges.

- Tax Efficiency: Reducing tax liabilities is a key component of wealth management. Portfolio services help structure investments to maximise after-tax returns.

Portfolio Services for Businesses

For businesses, financial portfolios are critical for sustaining operations and planning for growth:

- Corporate Investment Strategies: Businesses often hold funds that can be strategically invested to generate additional income.

- Risk Management: Identifying and mitigating financial risks, such as currency fluctuations or market downturns, is crucial for stability.

- Cash Flow Management: Ensuring sufficient liquidity while maintaining reserves for emergencies or opportunities is a delicate balance that portfolio services handle effectively.

- Employee Benefit Plans: Offering competitive retirement or incentive programmes can enhance employee retention and satisfaction while aligning with the company’s financial goals.

The Benefits of Professional Portfolio Management

Professional portfolio management provides access to expertise that goes beyond what most individuals or businesses can achieve alone. Services include ongoing monitoring, rebalancing to adapt to market changes, and insights into emerging opportunities. Additionally, professionals bring a disciplined approach that eliminates emotional decision-making, ensuring your portfolio performs optimally based on informed decisions.

Choosing the Right Service Provider

Selecting the right portfolio management provider is essential. Rodcas group has a team with strong credentials, transparent fee structures, and a track record of success. A reputable provider will offer customised solutions, tailored to your specific needs, whether personal or corporate.

Postulate no.1: Act Now for a Secure Financial Future

Current economic trends underline the importance of professional portfolio services. With inflation, market volatility, and new investment opportunities, now is the perfect time to act. By entrusting your portfolio to experts, you can achieve financial stability and long-term success. Contact us today to explore how tailored portfolio management services can help you thrive.