The US crypto industry is on the verge of major regulatory shifts as Crypto Czar David Sacks teases upcoming policy announcements. With regulatory bodies like the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) working in unison, the stage is set for a more structured approach to crypto regulations.

US Regulators Align on Crypto Policies

Crypto regulations in Washington have been evolving rapidly, with multiple governmental groups stepping in. The SEC’s crypto task force, the CFTC’s pilot programme, the Presidential Working Group, and Congress’s Bicameral Working Group for Digital Assets are all actively engaged. While concerns have arisen about regulatory overlap, experts assure that these groups are coordinating rather than conflicting.

David Sacks’ associate Bo Hines has facilitated collaboration, recently meeting with SEC Commissioner Hester Peirce and Acting CFTC Chair Caroline Pham to align efforts. Meanwhile, industry groups like the Blockchain Association and Chamber of Digital Commerce have engaged regulators on crucial topics such as ETF staking, stablecoin oversight, and tokenized assets.

Sacks confirmed these developments, stating, “The inter-agency Working Group on Digital Assets is working well together to implement the President’s agenda. Bo Hines is doing a fantastic job as Executive Director keeping everyone coordinated. Some important announcements are coming soon.”

Sacks confirmed these developments, stating, “The inter-agency Working Group on Digital Assets is working well together to implement the President’s agenda. Bo Hines is doing a fantastic job as Executive Director keeping everyone coordinated. Some important announcements are coming soon.”

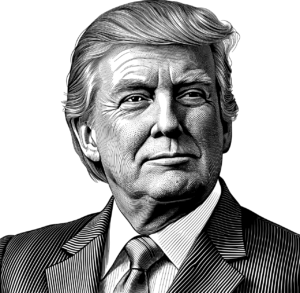

Trump Administration’s Pro-Crypto Approach

Since taking office, President Donald Trump has taken swift action to support the crypto sector. One of his key executive orders directed David Sacks and his team to assess Bitcoin’s potential as a reserve asset, marking a significant departure from previous restrictive policies.

Among the most notable regulatory reversals was the SEC’s repeal of the controversial SAB 121 accounting rule, which had previously hindered banks from offering digital asset services. Additionally, the Federal Deposit Insurance Corporation (FDIC) has introduced new guidelines allowing US banks to handle crypto assets and tokenized deposits without requiring prior regulatory approval.

Further strengthening these efforts, a US judge recently paused the SEC’s lawsuit against Binance for 60 days, allowing a newly formed task force to reassess crypto regulations. A status report is expected by April 14.

Further strengthening these efforts, a US judge recently paused the SEC’s lawsuit against Binance for 60 days, allowing a newly formed task force to reassess crypto regulations. A status report is expected by April 14.

With SEC and CFTC coordination, Bitcoin reserve discussions, and pro-crypto regulatory changes, the US crypto industry is entering a pivotal phase, setting trends that influence the global crypto market. As the US shapes regulatory standards, fosters institutional adoption, and drives innovation, other nations are closely watching and adapting their policies.

Stay informed,

Rodcas Consulting Group