Regarded as a true legend in the crypto world, Michael Saylor, the CEO of Strategy (formerly MicroStrategy), has become one of the most influential figures in the cryptocurrency industry. Once a tech entrepreneur with a turbulent financial past, Saylor has transformed his company into the ultimate Bitcoin whale. With 471,107 BTC worth approximately $50 billion, he has not only reshaped Strategy but also established himself as a billionaire with a net worth of $9.4 billion.

A Bitcoin Alchemist on the Rise

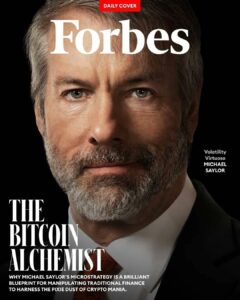

In a recent interview, Forbes magazine—on whose cover he appeared—aptly named him ‘The Bitcoin Alchemist,’ and for good reason. Saylor’s journey into Bitcoin began in 2020 when he viewed the US dollar as ‘trash’ amid the massive fiat printing triggered by the COVID-19 pandemic. Unlike traditional investors who sought refuge in bonds, he placed his faith in Bitcoin’s scarcity, driven by its 21 million token limit. With $530 million in cash reserves, he made a historic decision: Strategy would go all-in on Bitcoin.

Since then, Saylor’s strategic moves have cemented his company’s dominance in the crypto market. ‘We put a crypto reactor in the middle of the company and spin it,’ he told Forbes, emphasizing how Bitcoin’s volatility fuels Strategy’s meteoric rise. This bold strategy propelled Strategy into the Nasdaq 100, with its stock surging over 700% in 2024 alone.

Weaponizing Volatility: A Wall Street Playbook

One of Saylor’s most ingenious strategies was leveraging Bitcoin’s volatility to create liquidity. In 2021, he started issuing billions in convertible bonds, allowing investors to convert debt into Strategy shares. “People thought I was crazy,” Saylor admitted, yet Wall Street couldn’t resist the returns.

The Strategy has issued six convertible notes since 2021, totalling $7.3 billion, with interest rates between 0% and 2.25%. The most recent $3 billion note, issued in November, gained 89% within months. His stock has soared 2,666% since 2020, drawing comparisons to Tesla and Amazon.

What Happens if Bitcoin Crashes?

With Bitcoin’s history of volatility, many question the risks of Strategy’s aggressive approach. However, Saylor remains unfazed. “Actually, there’s very little debt on Strategy’s balance sheet,” said Jeff Park from Bitwise. Even if Bitcoin were to crash by 80% and stay down for two years, Strategy’s strategy would remain intact.

Saylor believes that Bitcoin’s future is inevitable and that its crash is not a real scenario. “Cash is trash,” he reiterated, confident that increasing national debt and pro-crypto policies under Trump’s administration will further solidify Bitcoin’s role in the global economy.

The Legacy of Michael Saylor

Despite past financial setbacks, Saylor’s unwavering belief in Bitcoin has reshaped the economic landscape. “The irony of my career is I invented 20 things and tried to make them successful, and I really didn’t change the world with any of them,” he reflected. “Satoshi created one thing, gave it to the world, and disappeared, and now we just carry the torch. That, ironically, has made me more successful.”

Saylor’s legacy is now firmly tied to Bitcoin’s future. Whether seen as a genius or a risk-taker, one thing is certain—he has forever altered the relationship between Wall Street and cryptocurrency.

Stay informed,

Rodcas Consulting Group