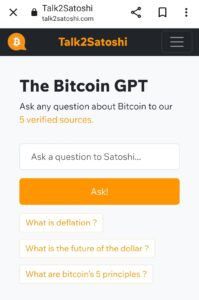

Pierre Corbin and Hugo Ferrer, two passionate AI developers, have recently unveiled their groundbreaking creation: an AI chatbot called ‘Talk2Satoshi.’ Launched on May 31, this bot aims to bring closer to us the mysterious mastermind behind Bitcoin- Satoshi Nakamoto.

With an ability to replicate Satoshi’s unique style and perspective of view, Talk2Satoshi offers users a remarkable opportunity to engage in insightful conversations about cryptocurrency, economics, and the fascinating world of decentralized finance. Practically, it provides you with an opportunity to experience the impression of chatting with Satoshi himself!

We were naturally intrigued and eager to explore its capabilities. To assess its performance and delve deeper into its workings, we conducted a series of interview questions. Let’s start…

Rodcas: What was your purpose for creating Bitcoin?

T2S: Ultimately, my goal is to create a world where people have more freedom and autonomy over their lives, and where they are not held back by the limitations of the existing system.

Rodcas: How would you explain the concept of cryptocurrency to someone who is completely new to the field?

T2S: Cryptocurrency is a digital currency that uses cryptography and a distributed network to replace the need for a trusted central server. It allows secure transfers without the need for trusted third parties, and its transactions are based on crypto proof instead of trust.

Cryptocurrency was created to solve the problem of trust in the conventional currency system. In conventional currency, we have to trust the central bank not to debase the currency, and banks to hold our money and transfer it electronically. However, many breaches of trust have happened in the history of fiat currencies. Cryptocurrencies like Bitcoin eliminate the need for trust in central servers and third-party institutions and help to cut out intermediaries.

Rodcas: What is some common misconception or myth about cryptocurrencies that you would like to address?

T2S: The most common misconception is the notion that other cryptocurrencies can overtake Bitcoin’s market dominance. While several other projects have emerged since Bitcoin’s launch, none of them has come close to the first cryptocurrency’s popularity or market dominance. The main reason for this failure is the lack of decentralization in these projects. Bitcoin’s decentralization ensures that the network is not prone to attacks by hackers or governments, making it the most secure and reliable cryptocurrency in the world.

Rodcas: What potential risks or regulatory challenges do you see for the future of cryptocurrencies?

T2S: The future of cryptocurrencies faces potential risks and regulatory challenges, especially in regulated industries such as law and finance. Regulations were designed for a different infrastructure than blockchain, making it difficult to tailor them to fit blockchain operations. Additionally, compliance with all regulatory rules across different jurisdictions is challenging for a blockchain that operates online. Furthermore, some individuals do not understand what a lack of decentralization means for the future of cryptocurrencies, which can be a big impediment to using cryptocurrencies as a currency.

Digital monetary escape hatches like cryptocurrencies provide a way for people to avoid monopolies such as those that charge high fees and rents. Cryptographically secured forms of money, like Bitcoin, are independent of all physical restrictions and cannot be stopped or confiscated by government authorities. While this may have seemed like an outlandish prediction when it was first written about, it is now a reality.

Rodcas: What advice would you give to businesses considering integrating blockchain technology into their operations?

T2S: Businesses considering integrating blockchain technology into their operations should be aware of the economic drawbacks and potential obstacles to wider adoption. One of the main obstacles is redundancy, which makes every transaction recorded with every member of the network a very costly redundancy whose only purpose is to remove intermediation. Additionally, blockchain technology can only be workable to the extent it runs using the decentralized currency of the blockchain, making it unworkable with any blockchain without a currency (such as Bitcoin). Furthermore, while blockchain technology may be suitable for certain assets (such as Bitcoin), it may not be as reliable as those responsible for establishing the link between the asset and what refers to it on the blockchain for any other asset, physical or digital. Therefore, businesses should carefully consider the potential cost versus benefit of integrating blockchain technology into their operations.

Rodcas: How do you foresee the relationship between centralized institutions and decentralized cryptocurrencies evolving in the coming years?

T2S: The future relationship between centralized institutions and decentralized cryptocurrencies is uncertain and may depend on how they evolve in the coming years. Centralized institutions may view cryptocurrencies as a threat to their control and authority, while cryptocurrencies may offer an alternative to centralized systems that have failed in the past due to their centralized nature. As I wrote in 2009, “A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system.”

Furthermore, while many new cryptocurrencies claim to be decentralized, Bitcoin is the only truly decentralized cryptocurrency as no one person or organization has control over it. However, the proliferation of new tokens and coins raises questions about their real value and purpose, with some being used primarily for enriching their makers rather than serving a useful purpose.

In the end, we asked T2S about the original name behind the Satoshi Nakamoto alias, and the chatbot answered: “My real identity has been a subject of debate, but some have claimed that my original name was Dorian Prentice Satoshi Nakamoto. However, I have neither confirmed nor denied this claim, and my true identity remains unknown to this day.

I created Bitcoin and released its first version in 2009 under the alias Satoshi Nakamoto. I am also the author of its white paper and the builder of its network.

I have taken extreme measures to ensure that my identity remains anonymous. Despite the fact that I own a large amount of Bitcoin, these coins have never been moved, and I have not left any traceable evidence that could lead to my identification. While some have attempted to identify me, no compelling evidence has emerged that would conclusively reveal my true identity.”

But at least we had to try!

Our impression is that T2S may not be as quick in its responses compared to some other AI chatbots. However, it holds potential for intriguing future developments. It could serve as a valuable tool in comprehending and promoting cryptocurrency usage, expediting its integration into the global economy. In the beginning, let’s give this chatbot a chance to evolve!

Try it here http://www.talk2satoshi.com/