The recent surge in Bitcoin prices has prompted widespread interest from both seasoned investors and newcomers to the cryptocurrency scene. With BTC reaching new heights and surpassing the $60,000 mark, many are left questioning the factors driving this increase. We cannot help but wonder: what precisely is pushing forward Bitcoin’s ascent? One thing remains evident: the journey of Bitcoin “ad astra” is just beginning, with potential outcomes yet to be fully realized. In our opinion, these are two factors that have contributed to the recent rise in BTC:

- ETF Inflows and Market Anticipation

The recent surge in Bitcoin prices can be attributed to the approval of spot Bitcoin exchange-traded funds (ETFs) by the U.S. Securities and Exchange Commission (SEC). BlackRock has spearheaded this initiative, marking a historic milestone in the integration of digital assets into traditional financial instruments. With BTC now a core component of ETFs’ underlying assets, mainstream finance has embraced cryptocurrency like never before.

ETFs offer investors a regulated and accessible avenue to participate in Bitcoin’s price movements without direct ownership, thus democratizing access to cryptocurrency investments. The surge in ETF activity on February 27th, reaching 241,000 trades, signals increased institutional interest in Bitcoin. BlackRock’s iShares Bitcoin Trust also saw a significant surge, rising from 30,000 to 60,000 daily trades. This influx of investments through ETFs has leveled up Bitcoin to new heights.

- The Upcoming Bitcoin Halving

Adding to the buzz is the upcoming Bitcoin halving, a process that takes place approximately every four years. During each halving, the rewards for mining new Bitcoin are cut in half, thereby raising the production costs.

In the past, this limited supply method has consistently driven up the value of Bitcoin and it represents a natural process of BTC price rises. As the next halving approaches, investors are preparing for increased demand, which will likely push Bitcoin’s value even higher.

The Future of Bitcoin: Strength Amid Uncertainty

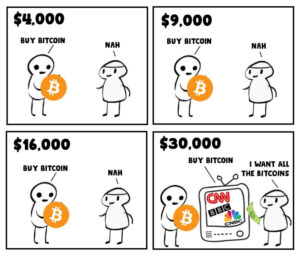

In conclusion, the recent surge in Bitcoin prices reflects its enduring appeal and the convergence of key market factors. From institutional investments to the impending halving event, the combination of ETF inflows and the approaching halving has created an ideal scenario for Bitcoin’s rise. This has bolstered investor confidence, leading to increased buying activity. Additionally, Bitcoin’s reputation as a sought-after investment opportunity has drawn in a fresh wave of enthusiasts, driving its value even higher.

As Bitcoin continues its ascent, the question on everyone’s mind is: where will it lead? While the future remains uncertain, one thing is clear: Bitcoin is stronger than ever. With institutional interest at an all-time high and the impending halving on the horizon, the stage is set for Bitcoin to assert its dominance in the cryptocurrency market.