Bitcoin, the world’s leading cryptocurrency, has always been known for its volatility. Recently, this volatility has become more pronounced, attracting significant attention from investors, especially the so-called “whales” – individuals or entities holding large amounts of Bitcoin. One particular whale made headlines by purchasing nearly $400 million worth of Bitcoin between July 30 and 31. This strategic move, even amid declining prices, indicates a strong belief in Bitcoin’s potential for a rebound. What do crypto whales know that we don’t?

The Whale’s Big Move

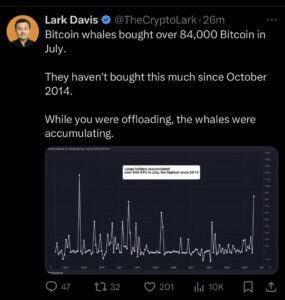

On-chain data reveals that this Bitcoin whale accumulated approximately 84,000 BTC over two days at the end of July. This massive purchase occurred despite Bitcoin’s price dropping to as low as $63,500 on July 31. Just days prior, Bitcoin had rebounded to nearly $70,000. The whale’s actions suggest they view this dip as a prime “buy the dip” opportunity, anticipating higher prices soon.

The Role of Whales in the Market

Whales play a crucial role in the cryptocurrency market. Their significant transactions can influence price movements and market sentiment. When a whale makes a large purchase, it can signal to other investors that the asset is undervalued, potentially leading to increased buying activity and a subsequent price increase. Conversely, large sales by whales can drive prices down.

In this case, the whale’s substantial purchase amid declining prices serves as a strong indicator of their bullish outlook on Bitcoin. This move has the potential to inspire other investors to follow suit, contributing to a price rebound.

Bitcoin’s Price Volatility

From everything we know before, Bitcoin’s price movements can be quite dramatic. After experiencing a significant drop to $63,500, the cryptocurrency is expected to rebound. Many analysts predict that Bitcoin could break above the $70,000 range during its next upward movement, potentially reaching new all-time highs which is expected to happen in September. This optimism is partly fueled by historical patterns and the broader market dynamics.

Historical Patterns and Future Expectations for Bitcoin

Historically, Bitcoin has shown a tendency to experience substantial price increases following a period known as the “Reaccumulation Range.” This phase often occurs around 100 days after a Bitcoin Halving event. A Halving reduces the reward for mining new blocks, effectively decreasing the rate at which new Bitcoin enters circulation. This supply reduction, combined with steady or increasing demand, often leads to price increases.

Although a breakout from the Reaccumulation Range isn’t guaranteed, the current market sentiment and whale activity suggest a positive outlook for Bitcoin. Investors like the recent whale are positioning themselves to profit from the anticipated price rally, demonstrating their confidence in Bitcoin’s future performance.

Preparing for a Breakout

Despite recent volatility, Bitcoin remains on track for a potential breakout in September. Investors and analysts alike are closely watching the market, looking for signs that could indicate the start of the next major price rally. The combination of historical trends, whale activity, and broader market dynamics all point towards a positive outlook for Bitcoin in the near future.

In summary, the recent activity of Bitcoin whales, particularly the significant accumulation by one whale, suggests a strong belief in an imminent price rebound. Despite the current volatility, the market sentiment remains optimistic, with many expecting Bitcoin to break above $70,000 and possibly reach new all-time highs. As always, investors should stay informed and consider the broader market trends when making investment decisions. Bitcoin is testing our patience once again, and all we have to do is participate in the game!

P.S. This text is informational in nature and is not advice for individual use that will suit everyone. Instead, it is best to consult with crypto consultants to develop an action plan that suits your goals and portfolio. Reach out to us for personalized consultations – we’re here to help you succeed.