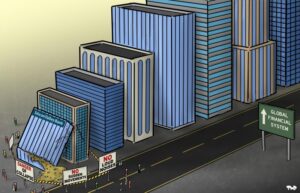

The traditional banking system is subject to a range of concerns voiced by critics. Trust in the banking system has been undermined by past financial crises and scandals, contributing to a general skepticism toward traditional banks.

The diminishing trust has given rise to a feeling that banks are confronting difficulties or possibly facing a state of decline (more about it here and here).

We have highlighted some of the main arguments that are the reason for the current state of the traditional banking system and are slowly but surely driving customers away from these services.

Centralization and control

Banks are centralized institutions that exert control over the flow of money. Some individuals perceive this control as limiting financial freedom, as banks have the authority to restrict access, freeze accounts, or impose transaction limits.

Lack of privacy

Banks require extensive personal information and adhere to strict regulatory procedures, which some individuals find invasive. The sharing of personal information with banks for compliance purposes can compromise privacy.

Limited access and exclusion

Traditional banking services may not be readily available to everyone, especially individuals in developing countries or marginalized communities. This lack of access can result in financial exclusion, preventing individuals from using banking services.

High fees and slow transactions

Banks often impose significant fees for various services, such as international transfers, currency conversions, and account maintenance. Additionally, transaction speeds can be slow, particularly for cross-border transfers, causing inconvenience for users.

Trust issues

There is a general lack of trust in centralized institutions, including banks. Past financial crises and scandals have led people to question the integrity of banks, citing concerns about corruption, fraud, and mismanagement.

Innovation and technological progress

Certain people value innovation and believe that traditional banks, with their legacy systems and slow adoption of new technologies, disturb progress. They argue that banks fail to meet the evolving needs of consumers in a digital and tech-driven world.

These points represent common concerns expressed by critics of the traditional banking system, especially from the perspective of those who advocate for decentralized alternatives like cryptocurrencies. These critics argue that the centralization and control exhibited by traditional banks, along with the lack of privacy, limited access, high fees, and slow transactions, highlight the need for a more transparent and efficient financial system. They believe that cryptocurrencies offer the potential to address these concerns by providing greater control over personal finances, enhanced privacy features, increased accessibility to financial services, lower transaction costs, and the possibility of fostering innovation in the evolving digital landscape.