Bitcoin has once again tested the patience of investors, with its price dropping to levels last seen in November 2024. While some may see this as a sign of trouble, seasoned traders know that volatility is just part of the game. Market cycles are normal, and this correction is nothing more than an opportunity for those who believe in Bitcoin’s long-term potential.

Volatility Is Normal—Bitcoin Is Not Dead

Bitcoin’s price briefly touched $82,256 before bouncing back, reflecting the usual ups and downs of the market. Corrections like this have happened countless times before, only to be followed by strong recoveries. The recent dip has been driven by factors such as large liquidations, spot Bitcoin ETF outflows, and fresh economic uncertainty caused by potential new tariffs on the European Union announced by US President Donald Trump.

Despite the short-term sell-off, independent analyst Scott Melker pointed out a bullish divergence in Bitcoin’s RSI, a key technical indicator. If this trend plays out as expected, it could signal that Bitcoin is gearing up for a rebound. Meanwhile, the Crypto Fear & Greed Index dropped to 21, marking ‘extreme fear’—a level that historically has often been a strong buying opportunity.

Smart Money Sees Opportunity—Bitcoin Is “On Sale”

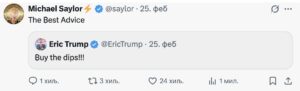

Billionaire Michael Saylor, one of Bitcoin’s most vocal advocates, took to social media to remind everyone that Bitcoin is simply “on sale.” His message echoes what many seasoned investors believe—volatility is a gift to those with conviction. Similarly, Eric Trump also encouraged people to buy the dip, reinforcing the idea that Bitcoin remains a powerful asset despite market fluctuations.

The long-term outlook remains strong, with institutional adoption continuing to rise. Even with the recent spot Bitcoin ETF outflows, demand for BTC is not vanishing—it’s simply shifting between different hands.

A Healthy Market Correction Before the Next Move-Up

Traders and analysts are currently watching Bitcoin’s next support levels, with estimates for a possible bottom ranging from $80,000 to $71,000. However, corrections are a natural and necessary part of a strong market. Each downturn shakes out weak hands while reinforcing Bitcoin’s position as a long-term asset.

Bitcoin isn’t going anywhere. History has shown that after every dip comes a new rally. For those who understand its true value, now is not the time to panic—it’s time to prepare for the next leg up.

Stay informed,

Rodcas Consulting Group