In the year 2023, the United States found itself on the edge of a financial precipice. The specter of a potential default loomed large, sending shockwaves through the global economy. This carried extensive ramifications that extended to the stability of the economy, the fulfillment of government obligations, and the confidence global markets had in the financial integrity of the United States.

The U.S. government, represented by President Joe Biden and Congress, is engaged in discussions about the U.S. debt ceiling. The discussions likely revolve around finding a suitable solution to address the debt ceiling and its potential implications. The debt ceiling refers to the maximum amount of debt that the government is legally allowed to accumulate. If the debt limit is not soon suspended or raised, the risk of a catastrophic default is real. Consequently, investors are seeking protective measures due to concerns over a potential default.

THE CHANGING US ASSET LANDSCAPE

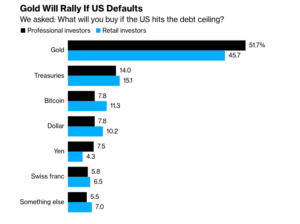

Bloomberg’s Markets Live Pulse conducted a survey to determine which assets would gain prominence in the event of a potential U.S. debt default. The findings indicate that in such a scenario, three key assets would rise to the forefront: Gold, U.S. Treasuries, and Bitcoin. Interestingly, the survey highlights Bitcoin’s increasing popularity, surpassing even the U.S. dollar.

As countries distance themselves from the dominance of the dollar, Bitcoin has emerged as a more popular choice. This represents the rising significance of decentralized digital currencies.

WHY IS BITCOIN SO ATTRACTIVE TO INVEST IN?

Bitcoin has garnered significant appeal among investors for several reasons. Firstly, the decentralized nature of Bitcoin, operating on a blockchain network, provides individuals with financial independence and a viable alternative to traditional banking systems. This becomes especially significant in an era where trust in banks is diminishing, making Bitcoin an attractive option for those seeking greater control over their finances.

Additionally, Bitcoin’s limited supply, with a maximum cap of 21 million coins, creates a perception of value and the potential for future price appreciation. This scarcity, combined with the cryptocurrency’s price increases, has attracted investors seeking potentially high returns.

Furthermore, Bitcoin’s global accessibility and liquidity make it easy to buy, sell, and transfer across borders, providing investors with flexibility and market participation.

Moreover, some investors view Bitcoin as a hedge against traditional financial markets, diversifying their portfolios and safeguarding against economic uncertainties, inflation, or geopolitical risks.

Lastly, Bitcoin represents a technological innovation that has attracted investors who are eager to participate in the future of digital currency. With the potential to transform the finance industry, Bitcoin has captivated the interest of forward-thinking investors.

In the midst of the uncertainties surrounding the US debt default, one thing remains clear: the financial landscape is evolving. Bitcoin’s rise as a top asset reflects a growing shift towards decentralized digital currencies and alternative investment options. As investors navigate these changing dynamics, it is crucial to stay informed, evaluate risks, and make well-informed decisions. Whether Bitcoin continues to shine amid the debt default or new opportunities emerge, adapting to the evolving financial landscape will be essential for investors to thrive in an ever-changing economic landscape.