In times past, many countries have expressed their interest in seeking financial independence by moving away from the US dollar as a reserve currency. In the global public sphere, speculations have arisen regarding the potential for the Chinese yuan to emerge as the dominant currency following the shift from the US dollar. However, a new contender has entered the scene: Bitcoin.

The news that has garnered attention is the shift in focus by the BRICS Alliance towards Bitcoin as a potential alternative for international transactions. By considering Bitcoin as an alternative, the BRICS nations are exploring new avenues.

THE IMPORTANCE OF BRICS EMPOWERING THE BITCOIN

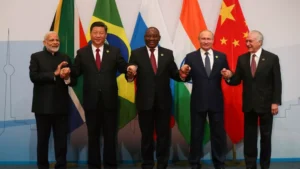

BRICS is an association of five major emerging national economies: Brazil, Russia, India, China, and South Africa. These countries are home to over 40% of the global population and contribute around one-fourth of the world’s GDP.

BRICS nations collaborate on platforms like the G20 and BRICS summits. They advocate for reforming international financial institutions and strive for a more balanced global economic order. Consequently, their actions and decisions significantly affect global economic growth, trade, and development.

Given their economic clout, the BRICS nations can play a significant role in shaping policies, standards, and regulations around cryptocurrencies and blockchain technology. Their influence and collaboration in this realm can contribute to establishing a more inclusive and balanced global financial system.

The BRICS nations aim to leverage the potential benefits of digital currencies for cross-border transactions and economic integration. To achieve this, they are implementing measures to limit the usage of cryptocurrencies within their countries, particularly with the intention of preventing any impact on the value of their national currencies.

The fact is that BRICS countries have the potential to drive the future of crypto empowerment on a global scale. Their actions and decisions in adopting and regulating cryptocurrencies can have an impact on the wider adoption and acceptance of cryptocurrencies worldwide.

It is now obvious: Bitcoin is Challenging Dollar Dominance. Although the Chinese yuan has been previously considered a potential successor to the dollar, Bitcoin’s rise offers an option in the global currency landscape.

THE BENEFITS OF BITCOIN FOR BRICS NATIONS

Bitcoin offers numerous benefits for the BRICS nations, and while there are several noteworthy advantages, we will highlight the most important and evident ones, including:

Diversifying Currency Reserves: Bitcoin presents an opportunity for the BRICS nations to diversify their currency reserves, reducing reliance on traditional fiat currencies.

Greater Financial Independence: The decentralized nature of Bitcoin appeals to these countries as it offers enhanced financial independence and autonomy. Embracing Bitcoin allows the BRICS nations to assert their independence from the traditional financial systems predominantly controlled by Western powers.

Cost Savings and Enhanced Security: Bitcoin transactions come with lower fees, providing cost savings for international transfers. Additionally, its security measures make it less vulnerable to hacking compared to centralized systems.

Empowering Underbanked Regions: Bitcoin has the potential to empower underbanked regions within BRICS countries by providing access to financial services that are otherwise limited or unavailable through traditional banking systems.

The BRICS nations’ empowerment of Bitcoin reflects their desire to reshape the global economy and reduce dependence on a single currency. This strategic move highlights the potential for a transformative shift in the global financial landscape.

By recognizing the potential of cryptocurrencies and blockchain technology, the BRICS nations are embracing the possibilities of a decentralized future.

This forward-thinking approach positions the BRICS nations at the forefront of financial innovation, as they pave the way for a more inclusive, balanced, and technologically advanced global economy.