Picture this: transactions that are automated, transparent, and secure, all without the need for intermediaries. Sounds like a dream, right? Well, welcome to the world of smart contracts. But what exactly are smart contracts, and how do they fit into the realm of crypto-finance?

What Are Smart Contracts?

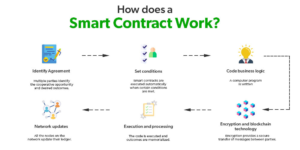

Smart contracts are self-executing contracts with predefined terms and conditions encoded into lines of code. They run on blockchain networks, ensuring transparency, security, and autonomy in executing agreements. Smart contracts offer a view into the future of finance, promising efficiency, cost savings, and accessibility on a global scale. In simpler terms, smart contracts are like traditional contracts, but they are written in code and executed by computers instead of relying on human intermediaries to enforce them. Тhey represent a significant innovation in contract law and business operations.

However, like all new technologies, it has its advantages and disadvantages. The use of smart contracts depends on what you need and for what purpose you use them, as well as whether you are okay with the fact that using this capability of automated contracts carries certain risks.

FOR:

- Using the Power of Automation:

Smart contracts streamline the execution of financial agreements, eliminating the need for manual processing and intermediaries. Imagine instant settlement of transactions, seamless loan approvals, and automated asset transfers—all at the click of a button. By reducing administrative overhead and human error, smart contracts pave the way for unprecedented efficiency in the world of finance.

- Empowering Financial Inclusion:

In a world where billions remain unbanked or underserved by traditional financial institutions, smart contracts offer a lifeline. With access to a smartphone and an internet connection, individuals anywhere in the world can participate in financial transactions, secure loans, and access investment opportunities. Smart contracts democratize finance, and make it world wide available.

AGAINST:

- Smart Contracts Management:

While the smart contracts are promising, realizing their full potential requires a deep understanding of programming languages, blockchain technology, and contract law. For many individuals and organizations, this presents a significant barrier to entry. Without the necessary technical expertise, deploying and managing smart contracts can be a hard task, limiting adoption and innovation in the crypto-finance space. So the only reliable way to use it is to delegate to financial and legal experts to manage them

- Mitigating Legal and Regulatory Risks:

In addition to technical challenges, smart contracts raise complex legal and regulatory questions. Are smart contracts legally binding? How do they comply with existing financial regulations? As governments struggle with these questions, uncertainty is all over the future of smart contracts in mainstream finance. Without clear legal frameworks and regulatory guidance, businesses may hesitate to fully embrace smart contract technology, fearing legal repercussions and compliance issues.

Conclusion: Balancing Promise with Pragmatism

As we weigh the pros and cons of smart contracts in crypto-finance, one thing is clear: the potential for innovation is huge. Yet, realizing this potential requires a delicate balance of ambition and pragmatism. While smart contracts offer unparalleled efficiency and transparency, their widespread adoption depends on overcoming technical, legal, and regulatory hurdles.

So, are smart contracts the future of finance? The answer lies not only in the technology itself but also in our ability to navigate the human resources needed to unlock its full potential. After all, the future of finance is in our hands.