After much anticipation, former President Donald Trump has finally announced the creation of a Crypto Strategic Reserve, a move that could mark a historic shift in the U.S. financial system and globally. The announcement has sparked discussions across the crypto industry, with major figures weighing how the reserve should be structured. Among them, Coinbase CEO Brian Armstrong has made a strong case for Bitcoin as the ideal reserve asset. At the same time other key players, including Arthur Hayes and Changpeng Zhao, have also shared their perspectives.

Armstrong: Bitcoin Is the Clear Successor to Gold

In a post on X, Armstrong suggested that Bitcoin alone would be the most effective option for the U.S. crypto reserve, given its status as a decentralised and widely recognised digital asset. He emphasised that Bitcoin’s role as the digital successor to gold makes it an ideal reserve asset. However, he also acknowledged that if a broader selection were needed, a market-cap-weighted index of cryptocurrencies could be a viable alternative.

Armstrong’s statement comes in response to Trump’s declaration that the reserve will include Bitcoin and Ether, with plans to incorporate Solana (SOL), XRP, and Cardano (ADA). This marks a significant step towards government engagement with crypto assets, though many industry experts remain sceptical about the feasibility of such a reserve.

Arthur Hayes and Changpeng Zhao Weigh In

Arthur Hayes, co-founder and former CEO of BitMEX, downplayed the significance of Trump’s announcement, arguing that it remains a theoretical move until Congress approves funding or revalues gold. According to Hayes, without financial backing, the government cannot accumulate Bitcoin or other cryptocurrencies.

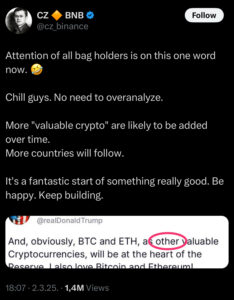

Meanwhile, Binance founder Changpeng Zhao took a more optimistic stance, urging the crypto community to remain patient. He suggested that more digital assets could be added to the reserve over time and that other nations may follow suit, making this a pivotal moment for global crypto adoption.

Market Reacts as Crypto Prices Surge

Trump’s social media posts triggered a strong rally in the crypto market. Bitcoin saw an 8% surge, while Ether jumped 11%. Other altcoins, such as XRP, Solana, and Cardano, experienced even more dramatic gains, climbing by 31%, 20%, and 68%, respectively.

The Future of a U.S. Crypto Reserve

The long-awaited Crypto Strategic Reserves is no longer just an idea—it is becoming a reality. While details on its implementation are still unfolding, the momentum behind this initiative signals a major shift in how digital assets are perceived at the highest levels of government. Armstrong’s endorsement of Bitcoin as the core reserve asset reflects a growing belief that the world’s first cryptocurrency is not just an investment but a foundational pillar of the future financial system. As more leaders embrace this vision, the world could be on the brink of a new economic era—one where digital assets play a central role in global financial stability.

Stay informed,

Rodcas Consulting Group